Official Minnesota M1 Form in PDF

The Minnesota M1 form plays a crucial role for individuals filing their state income tax returns. It serves as the primary document for reporting income, calculating tax liabilities, and determining any potential penalties for underpayment of estimated taxes. Key components of the M1 form include personal identification details such as name and Social Security number, alongside a detailed breakdown of income, withholding, and credits. Taxpayers must assess their Minnesota income tax for the current year and compare it to withholding and credits claimed. If the difference results in an underpayment, individuals may need to complete Schedule M15, which specifically addresses underpayment penalties. This schedule provides two methods for calculating penalties: the optional short method and the regular method. Each method has its own set of instructions and calculations, allowing taxpayers to choose the one that best fits their situation. Understanding the intricacies of the M1 form and its accompanying schedules is essential for ensuring compliance and avoiding unnecessary penalties.

Form Example

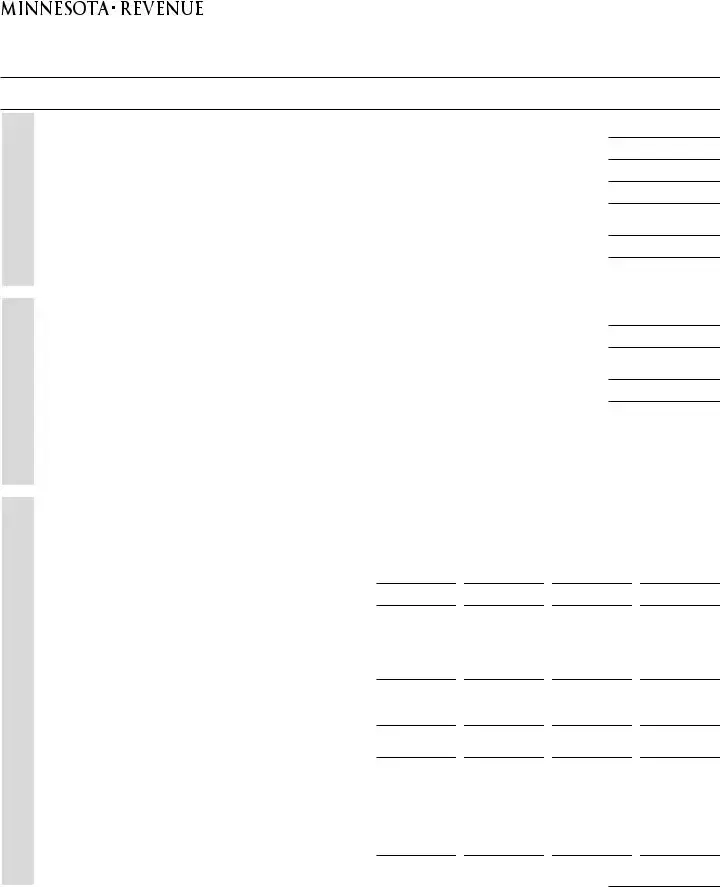

Schedule M15, Underpayment of Estimated Income Tax 2012

For Individuals (Form M1)

Sequence #10

Your irst name and initial |

Last name |

Social Security number |

Determine Penalty Using Required Annual Payment the Short Method

Determine Penalty Using the Regular Method

Required Annual Payment

1 Minnesota income tax for 2012 (FROM LINE 22 OF FORM M1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Minnesota withholding and credits for 2012 (ADD LINES 23 AND

3 Subtract line 2 from line 1. If less than $500, stop here; you do not owe an underpayment penalty . . . . 3

4 Multiply line 1 by 90% (.90). Farmers and commercial ishermen: Multiply line 1 by 66.7% (.667) . . . . . 4

5Minnesota income tax for 2011 (FROM LINE 22 OF FORM M1). See instructions if your 2011 federal

adjusted gross income was more than $150,000 or if you did not ile a 2011 return . . . . . . . . . . . . . . . . . 5

6 Required annual payment. Amount from line 4 or line 5, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . 6

•If line 6 is less than or equal to line 2, stop here; you do not owe an underpayment penalty.

•If line 6 is more than line 2, continue with line 7 or line 13, depending on which method you use.

Optional Short Method (see instructions to determine which method to use)

7 Estimated tax payments you made for 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Add line 2 and line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Total underpayment for the year. Subtract line 8 from line 6 |

|

(if result is zero or less, stop here; you do not owe an underpayment penalty) |

9 |

10 Multiply line 9 by 2% (.02) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11• If the amount on line 9 will be paid on or after April 15, 2013, enter 0.

• If the amount was paid before April 15, 2013, use the following computation and

enter the result on line 11: |

amount on |

|

number of days paid |

|

|

|

|

|

line 9 |

X |

before 4/15/13 |

X .00008 |

. . . . . 11 |

|

|

12 Penalty. Subtract line 11 from line 10. Enter result here and on line 33 of Form M1 |

. . . . . 12 |

|

|

||||

|

|

|

A |

B |

C |

D |

|

Regular Method |

|

|

April 15, 2012 |

June 15, 2012 |

Sept. 15, 2012 |

Jan. 15, 2013 |

|

13Enter 25% (.25) of line 6 in each column OR use the amounts from the annualized income installment work-

sheet on the back of this form. If you use the work-

sheet or are a farmer or isherman, see instructions . . 13

14 Credits. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . 14

15Overpayment. If line 14 is more than line 13, subtract line 13 from line 14. Enter the result here and add it

to line 14 in the next column. Overpayments in any quarter following an underpayment must irst be

applied to making up previous underpayments . . . . . . . 15

16Underpayment. If line 14 is less than line 13, subtract line 14 from line 13. Enter the result

here and go to line 17 below . . . . . . . . . . . . . . . . . . . . . . 16

17Enter the date of payment or April 15, 2013,

whichever is earlier (SEE INSTRUCTIONS) . . . . . . . . . . . . . . 17

18Number of days between the payment due date

|

and the date on line 17 |

18 |

|

|

|

|

|

|

|

19 |

Divide line 18 by 365. The result is a decimal |

19 |

. |

|

. |

|

. |

|

. |

20 |

Multiply line 19 by 3% (.03). Enter as a decimal |

20 |

. |

|

. |

|

. |

|

. |

21 Multiply line 20 by line 16 . . . . . . . . . . . . . . . . . . . . . . . . 21

22Penalty. Add columns

line 33 of Form M1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

You must include this schedule with your Form M1.

Worksheet - Annualized Income Installment

|

|

|

||||

|

|

|

|

|

|

|

Step 1 |

Amount from line 11 of federal Schedule AI of Form 2210. |

|

|

|

|

|

|

|

|

|

|

|

|

Step 2 |

Minnesota additions (SEE INSTRUCTIONS BELOW) |

|

|

|

|

|

|

|

|

|

|

|

|

Step 3 |

Add step 1 and step 2 |

|

|

|

|

|

|

|

|

|

|

|

|

Step 4 |

Minnesota subtractions (SEE INSTRUCTIONS BELOW) |

|

|

|

|

|

|

|

|

|

|

|

|

Step 5 |

Subtract step 4 from step 3 |

|

|

|

|

|

|

|

|

|

|

|

|

Step 6 |

Figure the tax for the amount shown in step 5. Deduct |

|

|

|

|

|

|

appropriate nonrefundable credits. Include annualized |

|

|

|

|

|

|

Minnesota alternative minimum tax. |

|

|

|

|

|

|

|

|

|

|

|

|

Step 7 |

Percentage for each period |

22.5% |

45% |

67.5% |

90% |

|

|

|

|

|

|

|

|

Step 8 |

Multiply step 6 by step 7 |

|

|

|

|

|

|

|

|

|

|

|

|

Complete Steps |

|

|

|

|

|

|

Step 9 |

Add the amounts from step 15 from all preceding |

|

|

|

|

|

|

payment periods. |

|

|

|

|

|

|

|

|

|

|

|

|

Step 10 |

Subtract step 9 from step 8 |

|

|

|

|

|

|

(IF RESULT IS ZERO OR LESS, ENTER 0) |

|

|

|

|

|

|

|

|

|

|

|

|

Step 11 |

Enter 25% (.25) of line 6 of Schedule M15 in each column |

|

|

|

|

|

|

|

|

|

|

|

|

Step 12 |

Enter step 14 of the preceding column. |

|

|

|

|

|

|

|

|

|

|

|

|

Step 13 |

Add step 11 and step 12 |

|

|

|

|

|

|

|

|

|

|

|

|

Step 14 |

Subtract step 10 from step 13 |

|

|

|

|

|

|

(IF RESULT IS ZERO OR LESS, ENTER 0) |

|

|

|

|

|

|

|

|

|

|

|

|

Step 15 |

Amount from step 10 or step 13, whichever is less. |

|

|

|

|

|

|

Also enter this amount on line 13 of Schedule M15. |

|

|

|

|

|

|

|

|

|

|

|

|

Instructions for Above Worksheet

Step 2

Using the amounts from lines 2 and 3 of Form M1, determine your Minnesota additions for each quarter. Enter the total amounts in

step 2.

Step 4

Using the amounts from lines 5 and 6 of Form M1, determine your Minnesota subtractions for each quarter.

Step 6 — Minnesota Alternative Minimum Tax

If the Minnesota alternative minimum tax applies, determine the amount of Minnesota alternative taxable income for each quarter.

Multiply that amount by the appropriate multiplier shown on line 2 of the federal Schedule AI of Form 2210. From the resulting annu- alized alternative minimum taxable income, subtract the appropriate minimum amounts depending on the iling status ($69,230 for married iling joint, $34,620 for married iling separately, or $51,930 for single or head of household) and multiply the difference by

6.4percent (.064). If the result is more than the regular tax shown on step 6, replace the regular tax with the Minnesota alternative minimum tax. See Schedule M1MT for instructions on iguring the Minnesota alternative taxable income.

Schedule M15 Instructions 2012

Underpayment of Estimated Income Tax for Individuals (Form M1)

Schedule M15 is for individuals only. Trusts and partnerships must use Schedule EST to determine if they owe a penalty for under- paying estimated tax.

Who Must File

If you are an individual, use this schedule to

determine if you owe a penalty for under‑ paying estimated tax.

You may owe an underpayment penalty if

you received income in 2012 on which $500 or more of Minnesota income tax is due

ater you subtract:

•the Minnesota income tax that was with‑ held from your income; and

•the total you claim for the refundable 2012 Child and Dependent Care, Work‑ ing Family, K‑12 Education, Increasing Research Activities, Angel Investment, Historic Structure Rehabilitation, Bovine Tuberculosis Testing and Job Opportu‑ nity Building Zone (JOBZ) Jobs credits.

You do not have to pay an underpayment penalty if all of the following apply:

•you did not have a Minnesota tax liability on line 22 of your 2011 Form M1;

•you were a Minnesota resident for all of

2011; and

•your 2011 return covered a

Nonresidents and

Farmers and commercial ishermen. If you

iled Form M1 and paid your entire income tax by March 1, 2013, or paid

do not have to complete this schedule.

You are considered a farmer or commercial isherman if two‑thirds of your annual gross income is earned by farming or commercial ishing.

Exceptions to the Penalty

If the Internal Revenue Service (IRS) does

not require you to pay additional charges for underestimating your federal tax

because you are newly retired or disabled, or because of a casualty, disaster or other unusual circumstances, do not complete Schedule M15. Include a copy of your fed‑ eral request with your Form M1.

Avoiding the Penalty

To avoid an underpayment penalty of esti‑ mated tax, you must have had withholding or made the required, timely estimated tax

payments and paid the lesser of:

•90 percent of your current year’s original tax liability (66.7 percent if you are a farmer or commercial isherman); or

•100 percent of your prior year’s total tax li‑

than $150,000, you must use 110 percent of your previous year’s tax liability instead of 100 percent.

Nonresidents and part‑year residents must have had at least $1 of Minnesota tax liabil‑ ity to use 100 percent of the prior year’s tax.

Fiscal Year Taxpayers

If you ile your Minnesota return on a iscal

year basis, change the payment due dates to the 15th day of the fourth, sixth and ninth

months of your iscal year, and the irst month of your next iscal year.

Line Instructions

hese instructions refer to your original re- turn. However, an amended return is consid- ered the original return if it is iled by the due date of the original return. Also, a joint Form M1 that replaces previously iled separate returns is considered the original return.

Line 5

If you did not ile a 2011 return, skip line 5 and enter the amount from line 4 on line 6.

Enter the amount from line 22 of your 2011 Form M1, unless your 2011 federal adjusted gross income (from line 37 of federal Form 1040 or line 21 of Form 1040A) was more than $150,000. Nonresidents and part‑year residents use Minnesota assignable adjusted gross income.

If your 2011 federal adjusted gross income was more than $150,000, multiply line 22 of your 2011 Form M1 by 110 percent (1.10). Enter the result on line 5 of Schedule M15.

Optional Short Method or Regular Method

You may use the optional short method only if:

•you did not make any estimated tax pay‑

ments (or your only payments were from

Minnesota income tax withheld from your wages); OR

•you paid your 2012 estimated tax in four equal amounts on or before the due date of each installment.

Note: If any payment was made before the installment due date, it is best to use the regular method. Using the short method will cause you to pay a larger penalty than

the regular method. If the payment was only a few days early, the diference is likely to be

small.

Continue with line 7 to use the optional short method.

If you are not eligible or you choose not to use the optional short method, use the regu‑

lar method to determine your underpay‑ ment penalty. Skip lines

with line 13.

Optional Short Method

Line 7

Enter the total amount of 2012 estimated tax

payments you made in 2012 and 2013. Do not include any other amounts on line 7.

Line 12

Subtract line 11 from line 10. his is the

amount of your underpayment of estimated tax penalty.

Enter this amount on line 33 of your 2012 Form M1.

If you owe an amount on line 32 of Form M1, add the penalty on line 12 of this schedule to the amount owed and replace line 32 of Form M1 with the total.

If you have a refund on line 30 of Form M1, subtract the penalty on line 12 of this schedule from your refund and replace line 30 of Form M1 with the result.

Continued

1 of 2

Regular Method

Complete column A, lines

Line 13

Enter 25 percent (.25) of line 6 in each of the four columns on line 13, unless one of the two following conditions applies to you:

1Your taxable income was higher at some times during the year and lower at others.

You may beneit by iguring your install‑

ments using the annualized income installment method. For example, if you received income from which no tax was

withheld in April or later, complete the worksheet on the back of Schedule M15.

he annualized income installment work‑ sheet automatically selects the smaller of the annualized income installment or the regular installment (increased by the amount saved by using the annualized income installment method in iguring earlier installments).

If you use this method for one payment

due date, you must use it for all. Follow the worksheet instructions on the back of

Schedule M15.

2You are a farmer or commercial isher‑

man and you did not pay your entire income tax by March 1, 2013, or you did not pay

January 15, 2013.

Enter the full amount of line 6 under column D of line 13 and omit columns A, B and C of line 13.

Line 14

For each payment period, enter the total amount of:

•estimated payments you paid for each payment period;

•Minnesota income tax withheld in 2012;

•your 2011 income tax refund, if you elected on your 2011 Minnesota return

to apply all or a portion of your refund to your 2012 estimated tax; and

•any refundable credits you claim for 2012.

You are considered to have paid any Min‑

nesota income tax withheld or received any

refundable credits (Child and Dependent

Care, Working Family,

Jobs credits) evenly during the year unless you show otherwise. If you worked all year,

divide the total amount of withholding and credits by 4, and enter the result in each col‑ umn. Your 2012 refund, if any, is considered a credit to your irst payment period.

If you iled your 2012 Minnesota return and paid the tax you owed on or before Janu‑ ary 31, 2013, you may consider the tax paid

as of January 15, 2013.

Lines 15 and 16

Compare line 13 of each column to line 14 of the same column.

If line 14 is more than line 13, you have an overpayment for the payment period. Subtract line 13 from line 14 and enter the result on line 15.

Add line 15 to the credit on line 14 of the next column. Overpayments in any quarter

following an underpayment must irst be

applied to making up previous underpay‑ ments.

If line 14 is less than line 13, you have an underpayment for that payment period.

Subtract line 14 from line 13 and enter the result on line 16. Continue with line 17.

Line 17

If you have an underpayment in all four quarters, in each column enter the date you iled your return or April 15, 2013, which‑ ever is earlier.

Otherwise, enter the date when the under‑ payment on line 16 was paid in full.

Example: You made your irst quarter estimated tax payment on April 20, but you show an underpayment on line 16. On June

14, you paid your second quarter payment in full and included the underpayment from the irst quarter. On line 17, you would enter June 14 in the irst and second quarter columns.

Line 22

Add the amounts on line 21, columns

amount of your underpayment of estimated tax penalty.

Enter this amount on line 33 of your 2012 Form M1.

If you owe an amount on line 32 of Form M1, add the penalty on line 22 of this schedule to the amount owed and replace line 32 of Form M1 with the total.

If you have a refund on line 30 of Form M1, subtract the penalty on line 22 of this schedule from your refund and replace line 30 of Form M1 with the result.

2 of 2

Form Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Minnesota M1 form is used to determine if individuals owe a penalty for underpaying estimated income tax. |

| Eligibility | This form is for individuals only. Trusts and partnerships must use a different form (Schedule EST). |

| Governing Law | The M1 form is governed by Minnesota Statutes, Chapter 289A, which outlines tax laws for individuals. |

| Payment Threshold | If the underpayment is less than $500, no penalty is owed. This threshold is crucial for avoiding penalties. |

| Methods of Calculation | Taxpayers can choose between the Optional Short Method or the Regular Method to calculate any penalties owed. |

Popular PDF Templates

Minnesota R 20 - Prospective employers and their addresses must be identified in the application process.

The Illinois Operating Agreement form is a crucial document that outlines the management structure and operational procedures of a limited liability company (LLC) in Illinois. This agreement helps define the rights and responsibilities of members, ensuring smooth business operations. For further assistance, refer to the Illinois PDF Forms. Ready to get started? Fill out the form by clicking the button below.

What Time Do Repos Happen - Establishes a legal foundation for repossession and subsequent title application processes in Minnesota.