Official Minnesota M30 Form in PDF

The Minnesota M30 form is a crucial document for businesses operating within the state, serving as the primary means for reporting and calculating Minnesota occupation taxes. This form encompasses various essential components, including the declaration of tax liabilities, credits, and any overpayments or amounts due. Businesses must provide detailed information such as their Minnesota tax ID, federal employer identification number (FEIN), and contact details. The form also requires a declaration regarding federal examinations, which can impact tax calculations. Furthermore, it includes sections for reporting income, deductions, and apportionment factors, ensuring that businesses accurately reflect their financial standing. Understanding how to complete the M30 form is vital, as it not only affects tax obligations but also compliance with state regulations. Timely and accurate submission can prevent penalties and interest, making it imperative for businesses to prioritize this important task.

Form Example

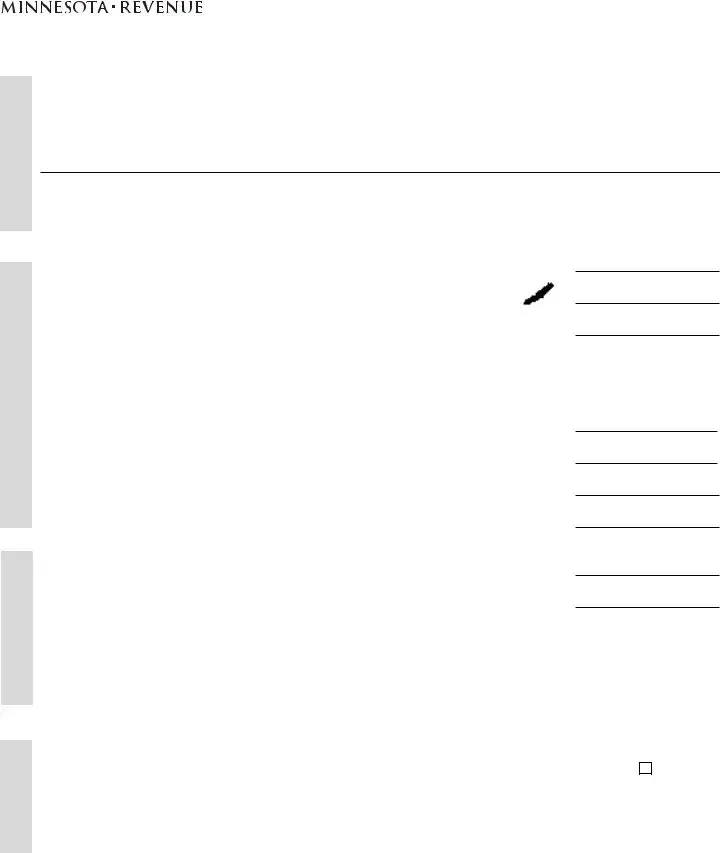

M30

2005 Occupation Tax

Print or type

Tax, payments and credits

Amount due or overpaid

Sign here

Name of company |

Minnesota tax ID |

FEIN |

|

|

|

|

|

Street |

|

|

|

|

|

|

|

City |

County |

State |

Zip code |

Has a federal examination been finalized? (list years) |

|

Report changes to federal income tax |

||

Is a federal examination now in progress? (list years) |

|

|

within 180 days of final determination. |

|

|

|

If there is a change in tax, you must |

||

|

|

|

|

|

Tax years and expiration date(s) of federal waivers: |

|

|

report it on Form M30X. |

|

|

|

|

|

|

1 |

Minnesota tax liability (from |

. . . |

. . . . . . . . . . . . . . . . . . |

. 1 |

2 |

Minnesota Endangered Resource Partnership Donation (see instructions, page 3) . . . . |

2 |

||

3 |

Add lines 1 and 2 |

. . . . . . . . . . . . . . . . . . |

. 3 |

|

4 |

Amount credited from your 2004 return |

4 |

|

|

5 |

. .Extension payment |

. 5 |

|

|

6 |

Add lines 4 and 5 |

. . . . . . . . . . . . . . . . . . |

. 6 |

|

7 |

Subtract line 6 from line 3 |

. . . . . . . . . . . . . . . . . . |

. 7 |

|

8 |

Penalty (see instructions, page 3) |

. . . |

. . . . . . . . . . . . . . . . . . |

. 8 |

9 |

Interest (see instructions, page 3) |

. . . |

. . . . . . . . . . . . . . . . . . |

. 9 |

10 |

AMOUNT DUE or OVERPAID |

|

|

|

|

Add lines 7, 8 and 9 (if less than zero, also enter on line 12) . . |

. . . |

. . . . . . . . . . . . . . . . . . |

10 |

11 |

Payment made with this return |

. . . |

. . . . . . . . . . . . . . . . . . |

11 |

12 |

Overpayment |

12 |

|

|

1 3 |

. .Amount of line 12 to be credited to your 2006 tax |

1 3 |

|

|

14 |

. . .Refund (subtract line 13 from line 12) |

14 |

|

|

I declare that this return is correct and complete to the best of my knowledge and belief.

Authorized signature |

Title |

Date |

Daytime phone |

I authorize the |

|

|

|

|

|

|

|

|

|

|

( |

) |

Minnesota |

|

|

|

|

|

|

Signature of preparer |

Minnesota tax ID, SSN or PTIN |

Date |

Daytime phone |

Department of |

|

|

|

|

( |

) |

Revenue to |

|

|

|

discuss this |

||

|

|

|

|

|

|

Print name of person to contact within company to discuss this return |

Title |

Daytime phone |

tax return with |

||

|

|

|

( |

) |

the preparer. |

|

|

|

|

||

|

|

|

|

|

|

Attach copies of all supporting schedules as requested in instructions.

Mail to: Minnesota Revenue, Minerals Tax Office, 612 Pierce St., Eveleth, MN 55734

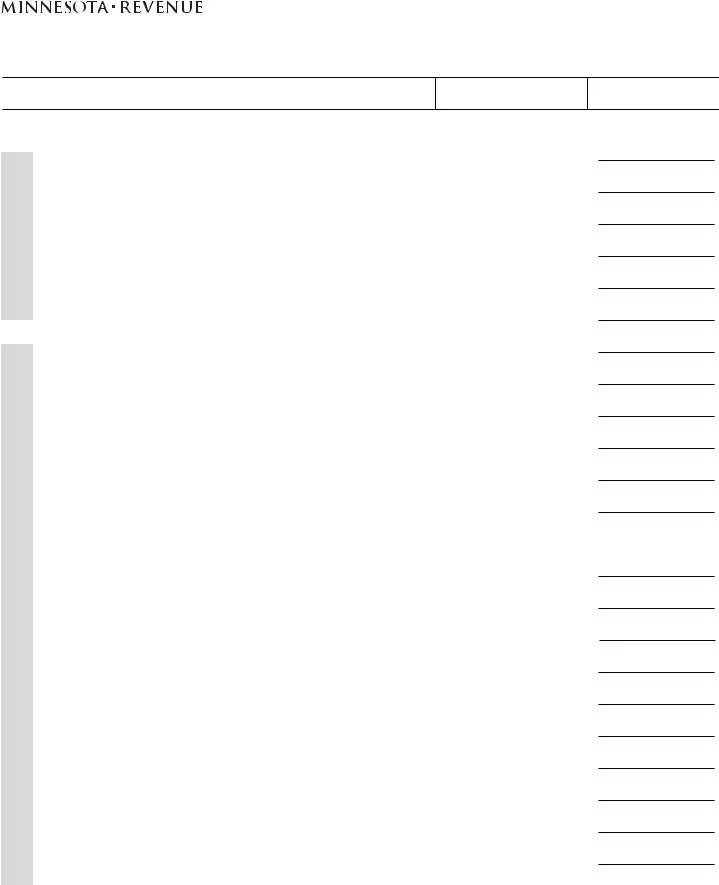

2005 Income Calculation

Attachment #1

Name of company

Minnesota tax ID

FEIN

Income

Deductions

1 Gross income (from

2 Cost of pellets produced (from Schedule A, line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 |

Gross profit (subtract line 2 from line 1) |

. . . . |

. . . . . . . . . . . . . . . . . . |

3 |

4 |

Net gain or loss (see instructions) |

. . . . |

. . . . . . . . . . . . . . . . . . |

4 |

5 |

Other adjustments (see instructions) |

. . . . |

. . . . . . . . . . . . . . . . . . |

5 |

6 |

Total income (add lines 3, 4 and 5) |

. . . . |

. . . . . . . . . . . . . . . . . . |

6 |

7 |

Salaries and wages |

. . . . |

. . . . . . . . . . . . . . . . |

7. . . . |

8 |

Repairs |

. . . . |

. . . . . . . . . . . . . . . . |

8. . . . |

9 |

Rents and leases |

. . . . |

. . . . . . . . . . . . . . . . |

9. . . . |

10 |

Royalties |

. . . . |

. . . . . . . . . . . . . . . . |

10. . . |

11 |

Taxes |

. . . . |

. . . . . . . . . . . . . . . . |

11. . . |

12 |

Interest |

. . . . |

. . . . . . . . . . . . . . . . |

12. . . |

13 |

Depreciation (see instructions) |

13 |

|

|

14 |

Less depreciation on Schedule A or elsewhere on return |

14a |

|

14b |

1 5 |

Eighty percent of federal bonus depreciation |

. . . . |

. . . . . . . . . . . . . . . . |

1 5. . . |

1 6 |

Subtraction for prior bonus depreciation addback |

. . . . |

. . . . . . . . . . . . . . . . |

1 6. . . |

17 |

Development |

. . . . |

. . . . . . . . . . . . . . . . |

17. . . |

18 |

Depletion (see instructions) |

. . . . |

. . . . . . . . . . . . . . . . . . |

18. . . |

19 |

Pension, |

. . . . |

. . . . . . . . . . . . . . . . |

19. . . |

20 |

Employee benefit programs |

. . . . |

. . . . . . . . . . . . . . . . |

20. . . |

21 |

Other deductions |

. . . . |

. . . . . . . . . . . . . . . . |

21. . . |

22 |

Total deductions (add lines 7 through 21) |

. . . . |

. . . . . . . . . . . . . . . . . . |

22. . . |

23 |

Minnesota net income (loss) (subtract line 22 from line 6) |

. . . . |

. . . . . . . . . . . . . . . . . . |

23. . . |

|

Enter on |

|

|

|

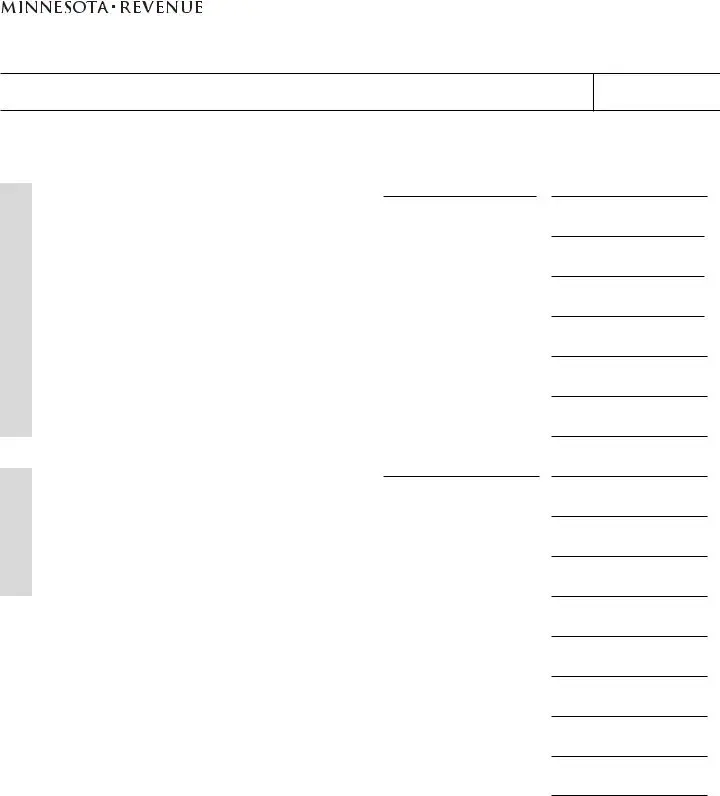

2005 Apportionment

Name of company |

Minnesota tax ID |

|

|

A

Total in and

outside Minnesota

1 Average inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2Average tangible property and

|

|

land owned/used (at original cost) |

2 |

|

ratio |

3 |

Capitalized rents (gross rents x 8) |

3 |

|

|

|

|

|

|

Property |

4 |

Total property (add lines 1 – 3) |

4 |

|

|

5 |

Percentage within Minnesota |

|

|

|

|

(see instructions, page 6 ) |

. .5 |

|

6 Factor weight . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Weighted ratio for PROPERTY (multiply line 5 by line 6) . . . . . . . . . . . . . . . . . . . . . . . 7

8 Payroll/officer’s compensation . . . . . . . . . . . . . . . . . . . 8

9Percentage within Minnesota

ratio |

|

|

(see instructions, page 6) |

. . . .9 |

||

|

|

|

||||

Payroll |

10 |

Factor weight |

. . . .10 |

|||

|

||||||

|

11 |

Weighted ratio for PAYROLL (multiply line 9 by line 10) . |

. . . .11 |

|||

|

12 |

Sales or gross receipts |

12 |

|

||

ratio |

|

|||||

13 |

Percentage within Minnesota (see instructions, page 6 ) |

. . .13 |

||||

|

||||||

Sales |

14 |

Factor weight |

. . .14 |

|||

|

||||||

|

15 |

Weighted ratio for SALES (multiply line 13 by line 14) . . . |

. . .15 |

|||

|

|

16 |

APPORTIONMENT FACTOR (add lines 7, 11 and 15 ) . |

. . .16 |

||

|

|

|||||

|

|

|

Enter on |

|

|

|

Attachment #4

FEIN

B

In Minnesota

0.125

0.125

0.75

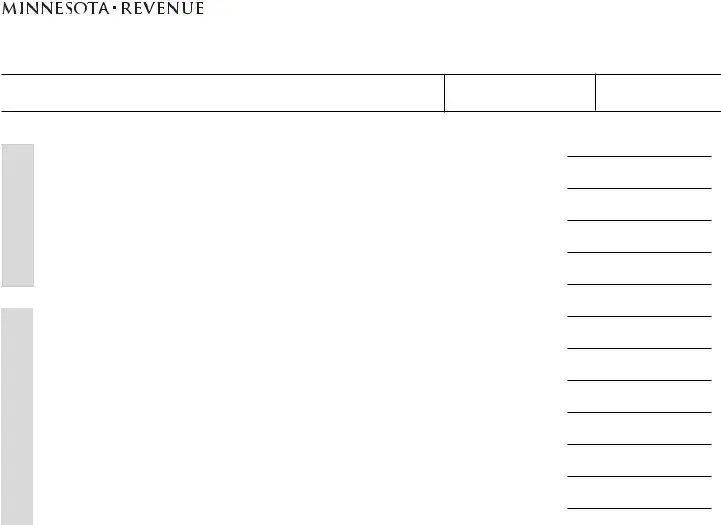

2005 Tax Calculation

Attachment #5

Name of company

Minnesota tax ID

FEIN

Income and deductions

Tax, credits and liability

1 |

Minnesota net income (from |

. 1 |

2 |

Apportionment factor (from |

. 2 |

3 |

Net income apportioned to Minnesota (multiply line 1 by line 2) |

. 3 |

4 |

Net operating loss deduction (from |

. 4 |

5 |

Taxable income (subtract line 4 from line 3; if zero or less, enter zero) |

. 5 |

6 |

Regular tax (multiply line 5 by 9.8% [.098]) |

. 6 |

7 |

Alternative minimum tax (from |

. 7 |

8 |

Add lines 6 and 7 |

. 8 |

9 |

AMT credit (from |

. 9 |

10 |

Subtract line 9 from line 8 |

10 |

11 |

Minnesota research credit (from |

11 |

12 |

Subtract line 11 from line 10. This is your MINNESOTA TAX LIABILITY |

12 |

|

Enter on M30, line 1. |

|

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Minnesota M30 form is used to report occupation tax, calculate tax liabilities, and claim credits for businesses operating within Minnesota. |

| Governing Law | This form is governed by Minnesota Statutes, Chapter 297A, which outlines the state's taxation policies and procedures. |

| Filing Requirements | Businesses must complete and submit the M30 form annually, including any necessary attachments, to the Minnesota Department of Revenue. |

| Penalties for Non-Compliance | Failure to file the M30 form on time may result in penalties and interest charges, emphasizing the importance of adhering to the submission deadlines. |

Popular PDF Templates

Minnesota Ig257 - Explains the need for authorization for the Department of Revenue to discuss return details with a preparer.

When engaging in the sale of a mobile home, it is crucial to utilize the proper documentation to ensure a smooth transaction. The Wisconsin Mobile Home Bill of Sale form serves as a formal record of this exchange, capturing essential information about the seller and buyer. To facilitate this process, you can find a useful Mobile Home Bill of Sale form that outlines the necessary details for both parties, helping to protect their rights and streamline the transfer of ownership within the state.

University of Minnesota Urolith - Comprehensive checklist regarding the source of stone samples, guiding submission based on the anatomical origin.

Minnesota R 20 - Details on communication abilities with the deaf through sign language demonstrate the inclusive approach to service provision.