Official Minnesota St101 Form in PDF

The Minnesota ST101 form, known as the Business Activity Questionnaire for Determining Sales Tax Nexus, plays a crucial role for businesses operating in or selling to Minnesota. This form helps the Minnesota Department of Revenue assess whether a business has a tax obligation in the state. It gathers essential information about the business, including its legal name, federal employer identification number, and the type of business entity. The form requires details about the business's activities, such as whether it has a physical presence in Minnesota, makes retail sales, or has employees working in the state. Additionally, it asks about the marketing and shipping of products to Minnesota consumers. Businesses must also disclose their sales figures for the past three years and any prior names or locations used in Minnesota. Completing the ST101 accurately is vital, as it determines the business's tax responsibilities and ensures compliance with state regulations.

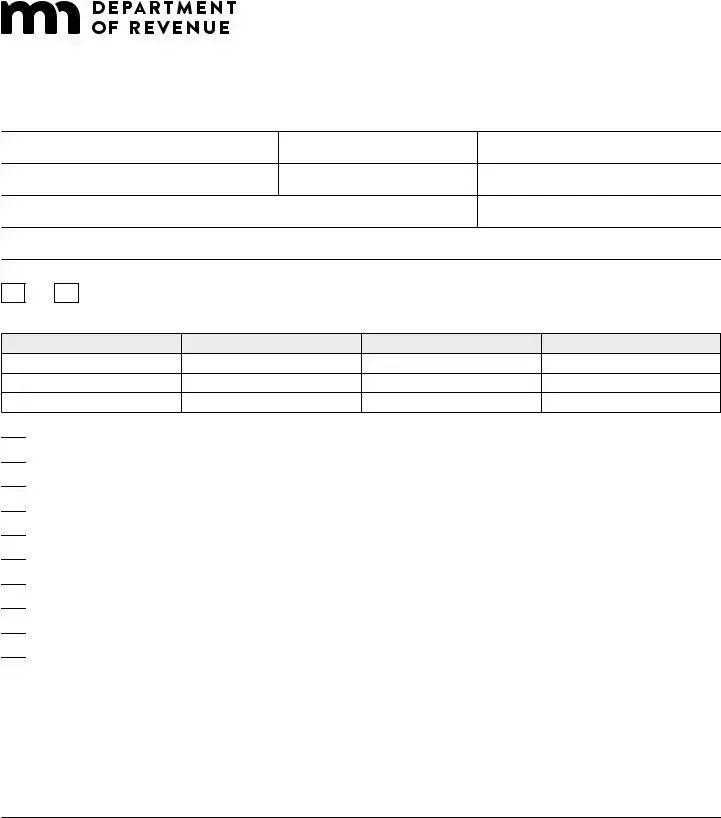

Form Example

Form ST101, Business Activity Questionnaire

This questionnaire helps the Minnesota Department of Revenue determine if you are required to register for and remit sales and use tax in Minnesota. After we review your questionnaire, we will send you a letter with our decision.

Business Information

Legal Name

Address

Web Address

Doing Business As (DBA) |

Federal Employer Identification Number (FEIN) |

||

City |

State |

|

ZIP Code |

|

|||

|

Email Address |

|

|

|

|

|

|

Describe your business activity:

Have you made or facilitated sales into Minnesota?

Yes

No

In the last three years, how many sales have you made or facilitated into Minnesota and what were your total sales?

From (Month/Year)

To (Month/Year)

Number of Sales

Total Sales (Dollar Amount)

Do any of the following apply to your business? Check all that apply:

Facilitates the sale of taxable goods or services to customers in Minnesota on behalf of a business

Facilitates the sale of taxable goods or services to customers in Minnesota on behalf of a business

Sells products to customers in Minnesota, using the internet, mail order, or telephone, without having physical presence in Minnesota

Sells products to customers in Minnesota, using the internet, mail order, or telephone, without having physical presence in Minnesota

Owns property or maintains a physical location in Minnesota (office, warehouse, or distribution, sales, or sample room)

Owns property or maintains a physical location in Minnesota (office, warehouse, or distribution, sales, or sample room)

Has an employee, representative, agent, or independent contractor working on your behalf in Minnesota

Has an employee, representative, agent, or independent contractor working on your behalf in Minnesota

Provides services in Minnesota

Provides services in Minnesota

Delivers items into Minnesota in its own vehicles

Delivers items into Minnesota in its own vehicles

Has displays at conventions or trade shows in Minnesota

Has displays at conventions or trade shows in Minnesota

Keeps inventory in a fulfillment center in Minnesota

Keeps inventory in a fulfillment center in Minnesota

Is an affiliate of a Minnesota retailer that promotes or provides other services to you and your business and the retailer are related parties

Is an affiliate of a Minnesota retailer that promotes or provides other services to you and your business and the retailer are related parties

Has an agreement to pay a commission or similar consideration to a Minnesota resident who directly or indirectly refers potential buyers to your business through website links or otherwise

Has an agreement to pay a commission or similar consideration to a Minnesota resident who directly or indirectly refers potential buyers to your business through website links or otherwise

Contact Information

|

|

|

|

Person(s) to Contact Regarding Information on this Questionnaire |

Title |

Phone |

|

|

|

|

|

Address |

City |

State |

ZIP Code |

|

|

|

|

Control number from correspondence letter (if applicable) |

|

|

|

Attach additional information necessary to explain the business operations in Minnesota and send electronically or mail the completed form to: Minnesota Department of Revenue

Mail Station 6330

600 N. Robert Street

St. Paul, MN

Email: salesuse.nexus@state.mn.us

Phone:

Rev. 5/21

Form Specifications

| Fact Name | Details |

|---|---|

| Form Title | ST101 Minnesota Business Activity Questionnaire for Determining Sales Tax Nexus |

| Purpose | This form helps determine if a business has a sales tax nexus in Minnesota. |

| Governing Law | Minnesota Statutes, Chapter 297A |

| Required Information | Businesses must provide details such as legal name, FEIN, and business type. |

| Registration Status | Businesses must indicate if they are registered to do business in Minnesota. |

| Sales Tax Filing | The form requires information about past sales tax returns filed in Minnesota. |

| Employee Information | Businesses must disclose if they have employees working in Minnesota. |

| Marketing Activities | Questions about marketing and shipping products/services to Minnesota are included. |

| Submission Instructions | Completed forms should be mailed or faxed to the Minnesota Department of Revenue. |

Popular PDF Templates

Pay Citation Online - The availability of this form reflects an understanding within the legal system of the diverse economic realities faced by individuals engaging in legal actions.

The Illinois Power of Attorney form is a legal document that allows an individual to designate another person to make decisions on their behalf regarding financial, medical, or other matters. This form is essential for ensuring that your preferences are honored when you are unable to communicate them yourself. For those looking to create this important document, resources such as Illinois PDF Forms can be very helpful in guiding you through the process.

When Can I Expect My Minnesota Renters Rebate? - For renters receiving Minnesota Housing Support, the CRP form offers a way to report these benefits properly.

Minnesota New Hire Reporting - Employer information section captures necessary contact information and the destination for Income Withholding Orders.